Featured Projects

On 05, Nov 2018 | In Branding Broadcast Scripts Copywriting Print / Mail | By Mitch Devine

UniCare: Songs About Insurance

:60 Radio – “Uninsured Blues”

Product: Individual Uninsured Coverage

Recorded at Lyon Studios

[Acoustic guitar, 12-bar blues]

BLUESMAN: [Singing]

Woke up this mornin’, stubbed my toe on the bed.

Then I slipped in the shower, got a lump on my head.

Had an aspirin for breakfast, gettin’ hurt ain’t no fun.

But I can’t see no doctor, ’cause I… ain’t even got one! But I got those mean-old-uninsured, down-on-my-luck healthcare blues. MUSIC: [carries under] ANNCR: Getting injured when you’re uninsured is no picnic.

But before you go taking out a loan to purchase health insurance, talk to the good folks at UniCare. They’ll set you up with a low-cost, individual health plan. They’ve even got those great new HSA-compatible plans with tax advantages. So stop singing the blues. Get quality health insurance you can afford from UniCare.

SINGER: Tell it, tell it! [music carries under]

TAG: [:10 LOCAL]

LEGAL 1 [TX/VA]: Application subject to UniCare approval. Insurance coverage offered by UniCare Life and Health Insurance Company.

________________________________________

:60 – “The Ballad of BusinessFlex”

Product: BusinessFlex Insurance

Recorded at Lyon Studios

Vocal: David Jeremiah

SINGER: [sung with country twang]

Yes, they call me the boss man,

Always telling me it’s time for a raise.

Next they’re asking me for health care,

They don’t understand that I’m the one who pays.

MUSIC: [carries under]

ANNCR: To business owners, everything costs money.

So ask the health insurance experts at UniCare how BusinessFlex can help you control costs. With BusinessFlex, you can offer a wide variety of options, some with tax advantages including HSA-compatible plans. You decide how much you contribute, so your monthly costs are manageable. And employees will be singing your praises.

SINGER: [sung] That’s why they call me the boss man…

MUSIC: [carries under]

TAG: [:10 local]

LEGAL [TX/VA]: Insurance coverage offered by UniCare Life and Health Insurance Company.

Direct Mail to Consumers

Direct Mail Campaign to Brokers

MAILER COPY (because white type on yellow is impossible to read!):

MAILER COPY (because white type on yellow is impossible to read!):

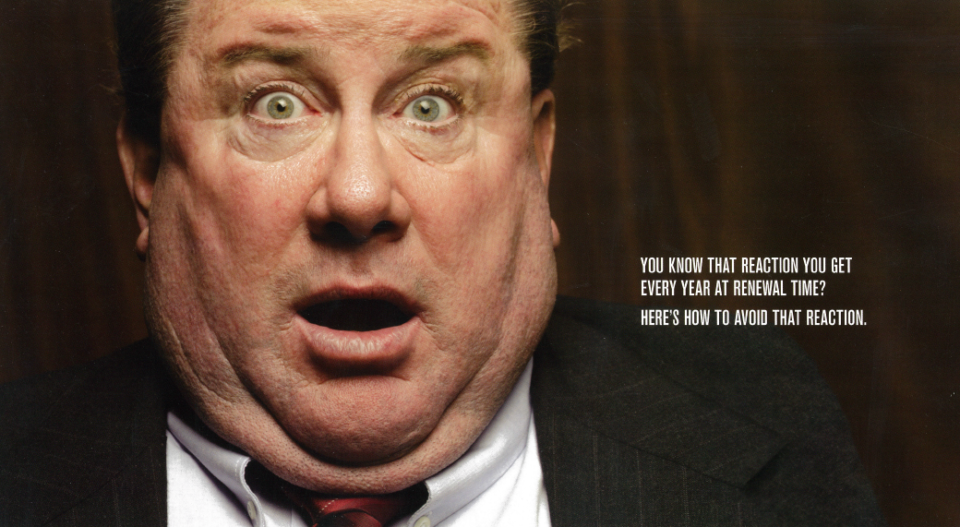

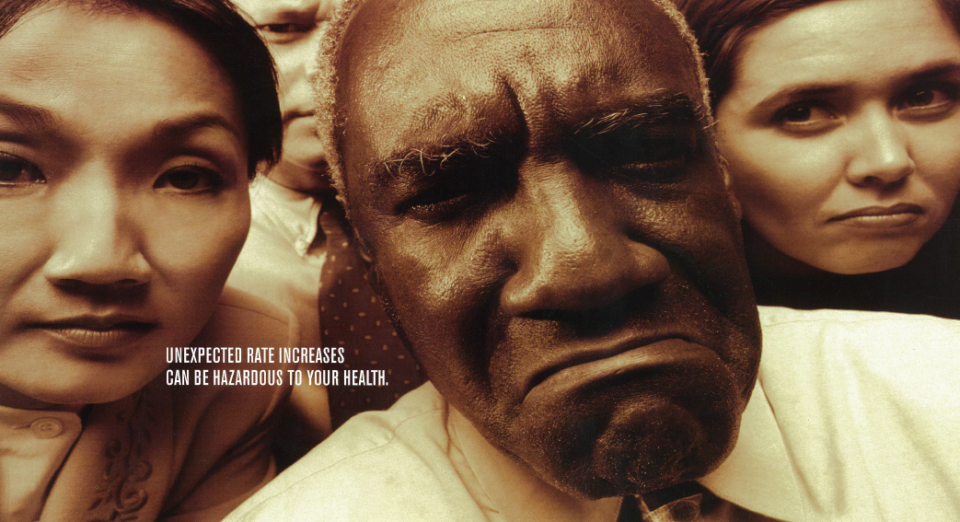

You know that reaction you get every year at renewal time?

Here’s how to avoid that reaction.

Not everyone likes surprises. Especially at renewal time. That’s why at UniCare Life & Health Insurance Company, we believe in getting more accurate information upfront, so we can provide more accurate rates, now and in the long run.

That means no unpleasant surprises for anyone. Not for your client, and equally important, not for you.

But we cant do it alone. So encourage your small business clients (the ones with 2–99 employees) to complete their individual medical questionnaires on each and every employee.

Rates will never stand still. But our goal is to provide fair and accurate rates based on a customized insurance plan for your client’s unique health benefit needs.

We want t0 give you our most accurate, competitive rates. They’ll want to give you a long-term relationship for years to come.

That should make everybody feel better.

Contact your Regional Sales Manager, Regional Sales Representative, or call UniCare Sales Support at 1-800-399-2273.

Direct Mail to Employers

With Pathways you can predict healthcare costs.

Now if you could just predict sick days.

Great news for businesses who thought they were too small to offer health coverage. You aren’t.

Now there’s a new low-cost health plan that covers every employee—even part-time and 1099 employees.

Pathways affordable health insurance from UniCare Life & Health Insurance Company that’s designed specifically for small businesses.

Monthly premiums start as low as $55, so you can offer health insurance to every employee, without sacrificing benefits. Accidents and ER visits are covered 100 percent up to $1,000. Preventive Care checkups are covered 100 percent up to $200. And your bookkeeper will appreciate the low-defined contribution, which means your cost stays the same. Always.

Learn more about how Pathways from UniCare can benefit your small business. Call UniCare and talk to a broker who can get you started. Or visit unicare.com.

# # #